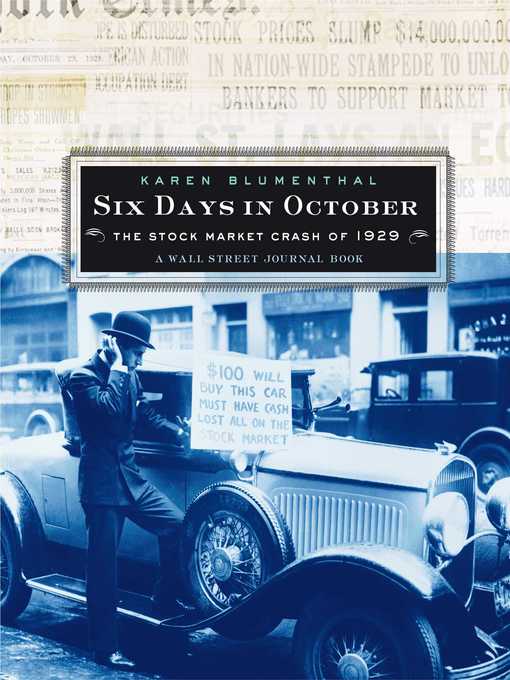

Six Days in October

The Stock Market Crash of 1929; a Wall Street Journal Book for Children

Here, Wall Street Journal bureau chief Karen Blumenthal chronicles the six-day period that brought the country to its knees, from fascinating tales of key stock-market players, like Michael J. Meehan, an immigrant who started his career hustling cigars outside theaters and helped convince thousands to gamble their hard-earned money as never before, to riveting accounts of the power struggles between Wall Street and Washington, to poignant stories from those who lost their savings—and more—to the allure of stocks and the power of greed.

For young readers living in an era of stock-market fascination, this engrossing account explains stock-market fundamentals while bringing to life the darkest days of the mammoth crash of 1929.

-

Creators

-

Publisher

-

Release date

February 12, 2013 -

Formats

-

Kindle Book

-

OverDrive Read

- ISBN: 9781442488915

-

EPUB ebook

- ISBN: 9781442488915

- File size: 9495 KB

-

-

Languages

- English

-

Levels

- ATOS Level: 7.9

- Lexile® Measure: 1040

- Interest Level: 9-12(UG)

- Text Difficulty: 6-8

-

Reviews

-

Publisher's Weekly

Starred review from September 2, 2002

This fast-paced, gripping (and all-too-timely) account of the market crash of October 1929 puts a human face on the crisis. Blumenthal, the Dallas bureau chief of the Wall Street Journal,

sets the scene in the affluent post–Great War society: she reproduces the famous January 1929 cartoon from Forbes

magazine (a frenetic crowd grasping at a ticker tape) and her statement "Executives who had spent their lives building solid reputations cut secret deals in pursuit of their own stock-market riches" may send a shiver down the spines of older readers aware of recent corporate scandals. The author deciphers market terms such as bull and bear, stock and bond in lucidly worded sidebars and describes the convergence of speculation, optimism and greed that primed the market for failure. Throughout, Blumenthal relates the impact of historical developments on everyday citizens. Supported by archival photographs, cartoons and documents, the text is rife with atmospheric detail about the customs of the stock exchange (from buttonhole flowers to the opening and closing gongs). Other asides, such as the first appearance of women on the exchange floor, or the rise (and fall) of immigrant Michael J. Meehan, who championed the stock of Radio Corporation, continue to keep the focus on the human element. Blumenthal ably chronicles the six-day descent and exposes the personalities, backroom machinations and scandals while debunking several popular myths about the crash (e.g., that it caused mass suicide and the Great Depression). A compelling portrait of a defining moment in American history. Ages 12-up. -

School Library Journal

October 1, 2002

Gr 8 Up-In this thoroughly researched work, Blumenthal focuses on the days leading up to and including the crash. Her account attempts to show that the event was not the result of one very bad day on Wall Street, but a culmination of unwise decisions and rampant speculation on the part of the American public, as well as banking and financial institutions. The dense text is filled with the specifics of the stock market and how it was turned on its head. Blumenthal does not delve into the economic depression the country faced after the crash, but concludes that the crash in and of itself was not the cause of the Great Depression. Many black-and-white, period photos; political cartoons; and reproductions of pages from newspapers, letters, and advertisements complement the text, rendering more reality to the story of an almost incomprehensible loss of fortunes and life savings. Chapter notes and other source material are included. Overall, this is a solid account of an important chapter in American history that offers more detail than Nathan Aaseng's The Crash of 1929 (Lucent, 2001).-Carol Fazioli, formerly at The Brearley School, New York CityCopyright 2002 School Library Journal, LLC Used with permission.

-

Booklist

November 1, 2002

Gr. 7-12. A " Wall Street Journal "bureau chief, Blumenthal combines a fascinating overview of the infamous stock market crash in 1929 with a rare and useful primer of financial basics. The chapters follow the six days surrounding the crash, but Blumenthal deftly places the events in context with vivid accounts of the stock-market fever that preceded the crash, often showing the impact of abstract issues through individual stories--the losses of Groucho Marx and of General Motors' founder William Durant are particularly astonishing. Rapid, simply constructed sentences increase the drama and suspense while making difficult concepts easily understood. Throughout, fact boxes define financial vocabulary--stocks, bonds, bulls and bears, margins, the measure of a company's worth, and more--in clear language that is both compelling and instructive. Archival images--photos, cartoons, and reproduced documents--enhance the text, as do frequent excerpts from newspapers and political quotes from the era. Students using this for research may be frustrated by the source citations, which appear as an appended, generalized chapter-by-chapter listing of materials consulted rather than as specific notes that correspond to text passages. But this still offers a riveting history, along with the basic terminology needed to grasp the events and to draw parallels between the volatile, sometimes corrupt, market of 1929 and the market today.(Reprinted with permission of Booklist, copyright 2002, American Library Association.) -

The Horn Book

January 1, 2003

Tracing the trajectory of the 1929 stock market crash across six days, Blumenthal provides a vividly drawn picture of Wall Street pandemonium, introduces key players, and explains often complex concepts. Illustrated with well-chosen black-and-white photos and reproductions (including editorial cartoons, balance sheets, and newspaper ads), the text contains colorful details that enhance the overarching story. Bib., ind.(Copyright 2003 by The Horn Book, Incorporated, Boston. All rights reserved.)

-

Formats

- Kindle Book

- OverDrive Read

- EPUB ebook

subjects

Languages

- English

Levels

- ATOS Level:7.9

- Lexile® Measure:1040

- Interest Level:9-12(UG)

- Text Difficulty:6-8

Loading

Why is availability limited?

×Availability can change throughout the month based on the library's budget. You can still place a hold on the title, and your hold will be automatically filled as soon as the title is available again.

The Kindle Book format for this title is not supported on:

×Read-along ebook

×The OverDrive Read format of this ebook has professional narration that plays while you read in your browser. Learn more here.